child tax credit after december 2021

The Child Tax Credit expires this month if Congress doesnt pass the Build Back Better bill. The expansion has increased the amount for children age 0 through 5 and children ages 6.

About The 2021 Expanded Child Tax Credit Payment Program

Why is a child credit so hard in the US.

. Unless you opted out of the monthly child tax credit payments you shouldve automatically received half of your estimated amount in 2021 from the IRS. Other free countries support their child. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

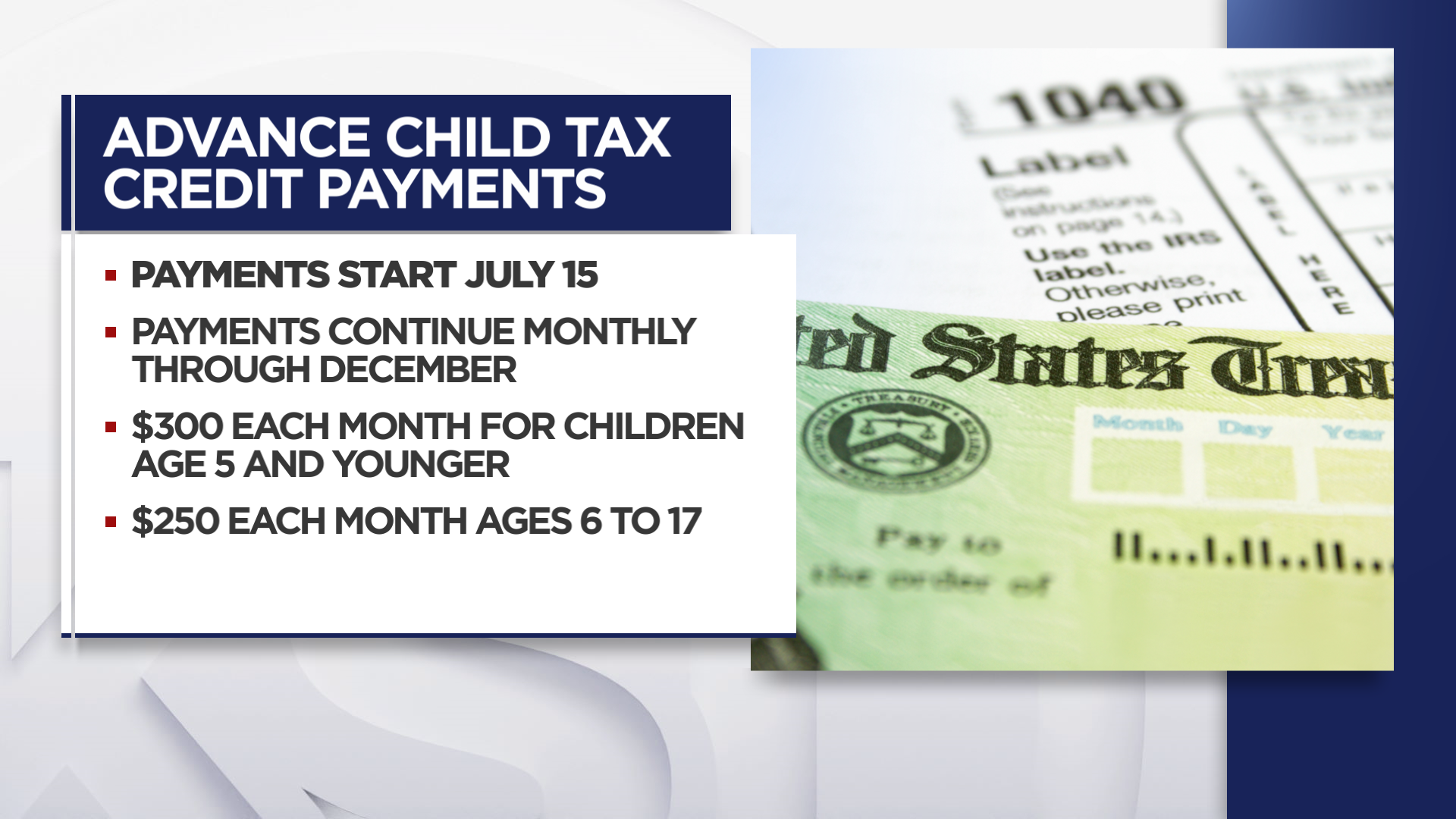

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Phil Murphy signed legislation Oct. The child tax credit wasnt new when Democrats over the objections of Republicans in Congress altered the program as part of Bidens 19 trillion coronavirus relief. 1 day agos part of the American Rescue Plan families received a Child Tax Credit with the first payments being made in July 2021 and the last one made on December 15 that same year.

4 fixing the timing of the states child tax. Before 2021 the child tax credit was worth 2000 for children age 0 through 16. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The remaining 1800 will. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of 3600 per child.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between. October 5 2022 807 am. The last child tax credit payment of 2021 is scheduled to go out on Wednesday Dec.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. Eligible families who did not opt out of the monthly payments are receiving 300. When taxes are filed in 2022 for the 2021 tax year parents will be able to cash in on the second half of their expanded child tax credit.

15 with the Internal Revenue Service IRS depositing most checks by direct deposit. Disbursement of advance Child Tax Credit payments. Just one day after an amended bill was passed by the Assembly Gov.

It helped roughly 60 million children and helped cut child. Children who attend college are qualifying children for. Before that though families will see the.

Eligible families who did not opt out of the monthly payments are receiving 300.

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

The Last Monthly Child Tax Credit Of 2021 Is Being Distributed

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

Expanded Child Tax Credit Here Are The New Changes This Year

Families Can Now Register For Child Tax Credit Payments

Child Tax Credit December Last Ctc Payments Delivered Today Marca

Final Check Child Tax Credit Payment For December Youtube

The December Child Tax Credit Payment May Be The Last

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Democrats Allow Child Tax Credit To Lapse As Omicron Surges World Socialist Web Site

Why Might The December Child Tax Credit Payment Be Bigger Than The Others As Usa

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit Talks Quietly Percolate Amid Advocates Push Roll Call

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wciv